The unexpected price of higher education

I am a communications student specializing in journalism at MacEwan University. Money quickly became a large factor in my decisions, including my choice of school to attend. I decided to take the first two years of my degree at a college with tuition costs nearly half that of Edmonton rates, but needed to transfer to a university to complete my degree.

Even after making financially stringent decisions, my student debt will fall slightly below the national average of $27,000, as per the Canadian Federation of Students.

My debt is not an isolated case. My three siblings, all of whom have or are studying for undergraduate degrees, have similar numbers to reconcile.

You could say inflation determines tuition costs, but consider this.

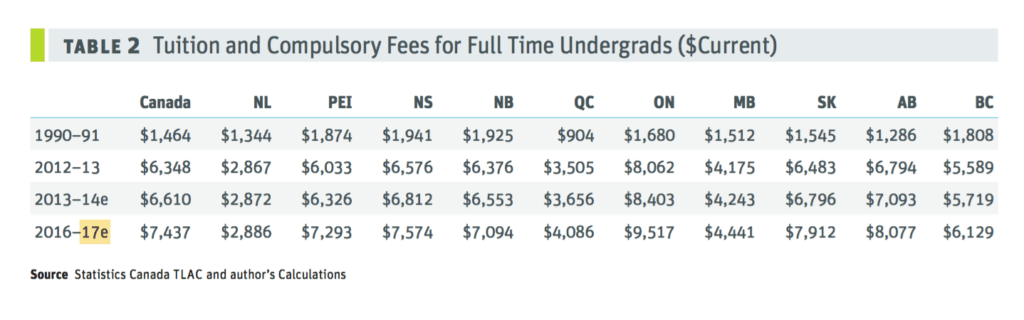

In 1984, average tuition was $1,000 per year. According to Statistics Canada, average tuition in 2015/2016 was $6,191. The Bank of Canada offers a handy inflation calculator that predicts the price of services according to national inflation rates. The average $1,000 tuition from 1984 calculated for 2016 should be approximately $2,139. That is a difference of roughly $4,000 above what inflation rates account for.

Similarly, The Canadian Centre for Policy Awareness noted a five-fold tuition increase from 1990–2017 and mandatory fees nearly tripled in the same time span. Tuition costs are exponentially increasing at rates students can no longer afford.

Despite these figures, post-secondary enrolment has only gone up in recent years. The steady increase is likely to continue as university degrees have become necessary to keep pace with the rapidly transitioning global economy.

Employment and Social Development Canada (ESDC) states 70 per cent of new jobs in the coming decade will require post-secondary education.

Many students take advantage of split-loan programs from both federal and provincial sources, which offer holds on interest until one year after graduation. Many also take out weighty bank loans with interest rates that begin immediately.

In a survey conducted in 2010, half of Canadian undergraduates owed money to their loan source (both governmental and private), 41 per cent of which was over $25,000. Any education beyond an undergraduate degree entails even higher amounts of debt.

Debt is one factor among many vexing young students pursuing an education; finding post-graduation work is another concern.

The job market is bleak for many recent graduates looking for a career in their field. Many students end up in service industry jobs even after completing their degrees in order to pay the bills. Others go straight to trades and begin a career that offers quick pay turnaround with short instructional periods.

Statistics Canada surveys have also found parents are even delaying retirement to help their children foot the cost of education. This only exacerbates the problem; each parent still working means one less job opening for another millennial.

With post-secondary debt come unexpected outcomes.

Delayed life milestones for millennials are a result of the vast difference between current tuition and the cost of living. Many young couples end up with significant debts to pay off at a time when their parents’ generation was buying a home and starting a family.

In past decades, tuition was much more proportional to the cost of living and milestones therefore came faster. It is only in the past generation that tuition has seen this unprecedented and unstable hike. When adding tuition to the cost of living, the price of a degree adds up quickly.

The Canadian Centre for Policy Awareness report released in 2013 states, “the cost of a four year university education is estimated to reach over $80,000; of that, residence is estimated at about $31,000.”

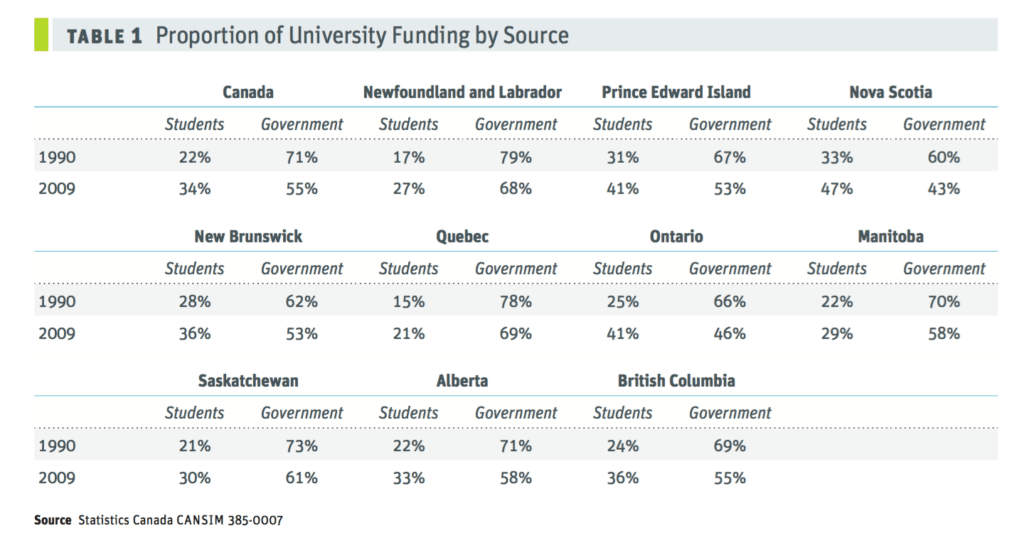

The report also said, “From 1989 to 2009, the proportion of university operating revenue from government sources fell from 81% to 58%, and the proportion funded by tuition fees increased from 14% to 35%.”

At the current rates, financial stability and independence is a dubious prospect, only becoming more difficult for Canadian students each year. This snowballing trend can’t help but leave myself and other millennials wondering if getting a university degree means putting life on hold.

Header Image: Recent graduates struggle with student debt and lack of work. Credit: Pauline Ismael